Useful informations

|

What to do in the event of a death? |

At Home:

If the death occurs at the deceased’s residence, a family member’s home, or under the care of someone, you should contact us. We will then assist in notifying the family doctor, attending physician, or, if necessary, the public health officer of the residence area to issue the Death Certificate.

In a Nursing Home/Institution:

If the death occurs in a nursing home or institution, the facility itself will inform the family, and the Death Certificate will be issued by the attending physician. After receiving notification of the death, you should contact us to begin the funeral arrangements.

Due to an Accident, Crime, or Suicide:

If the death results from an accident (traffic, workplace, suicide, drowning, crime, etc.), it is necessary to contact the relevant authorities in the area where it occurred.

The authorities will notify the public health officer and the Public Prosecutor’s Office. Until further instructions are given, the body should not be moved or touched.

In these cases, the Law requires an autopsy to be performed. The family should then contact us, as we will be informed by the official authorities of the date and time of the autopsy.

|

Documents to be presented |

Deceased's documents:

-

Identification Document (Citizen Card, Identity Card)

-

Taxpayer Card

-

Beneficiary Card (Social Security, Caixa Geral de Aposentações)

Spouse's or Applicant's Documents:

-

Identification Document (Citizen Card, Identity Card)

-

Taxpayer Card

-

Beneficiary Card (Social Security, Caixa Geral de Aposentações)

Documents to be signed by the spouse or applicant?

-

Funeral Agency Option

-

Cemetery Application

-

Others that may be requestedby the authorities

| Communication with the Tax Office |

If the deceased left assets, the heirs have until the end of the third month following the date of death to report the tax-free transfer at the tax office corresponding to the deceased’s fiscal residence.

Required Documents:

-

Death certificate

-

Deceased’s Taxpayer Card

-

Copies of the Identification Documents of the heirs

-

Copies of the Taxpayer Cards of the heirs

After this initial step, the heirs must list the movable or immovable assets (houses, land, vehicles, bank accounts, firearms) using Form 1 of the Stamp Duty Tax or by verbally declaring the details of the death, beneficiaries, and transferred assets. This declaration will be recorded in writing by a tax administration officer at the same tax office.

Additionally, if the deceased used to file IRS (Income Tax Return), the surviving spouse must remember to include the deceased’s earnings in the tax declaration for the following year and mark the respective field indicating the death of one of the holders.

|

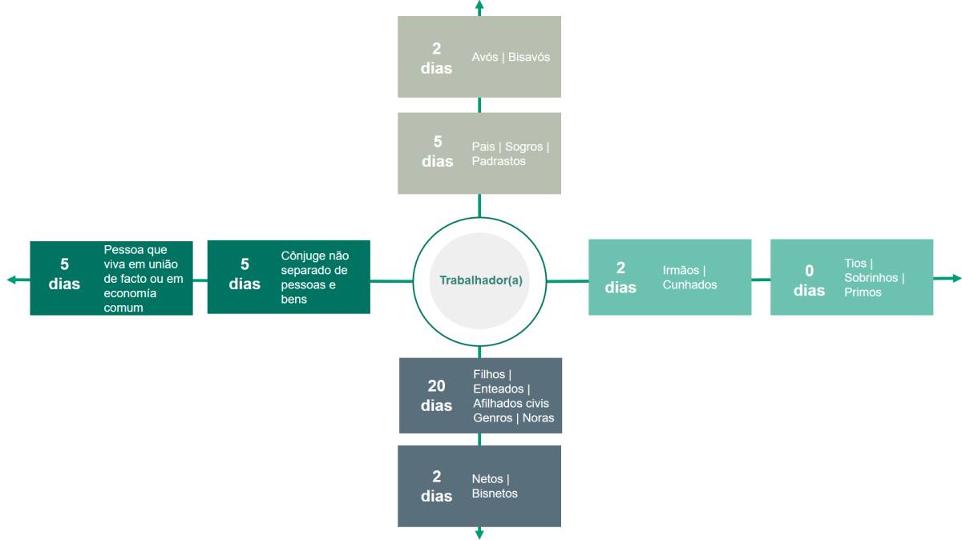

Bereavement Leave (Days Off in Case of Death) |